A new experiment from buy now, pay later (BNPL) company Affirm has people questioning just how far installment payments have crept into everyday life.

The fintech giant recently piloted a program that allows renters to split their monthly rent into biweekly paycheck-based payments, a move framed as a budgeting tool.

But critics are warning that the concept blurs the line between financial flexibility and never-ending debt, particularly as housing costs continue to skyrocket.

What is "buy now, pay later" rent?

Affirm partnered with fintech platform Esusu to test the rent-splitting payment plan. Under the pilot, eligible renters pay rent biweekly instead of monthly at a 0% APR. Affirm claimed there would be no late fees, hidden charges, or compounding interest for people who are approved for the plan.

Meanwhile, Esusu continued its core service of reporting on-time rent payments to major credit bureaus, meaning renters could build credit while paying rent through the program.

Affirm framed the pilot as a budgeting tool rather than a loan. In a statement to FOX Business, the company said it aimed to give renters "a transparent option that offers flexibility for renters to align expenses with their paychecks."

Affirm also said it reviewed each application individually. According to the company, approvals only covered amounts it believed renters could repay responsibly. (Although some could argue, and did on social media, that a company won't necessarily have renters' best interest in mind when there is profit to be made.)

Still, the company noted the program remained in early testing and did not have a plan for when it would roll out more widely.

Why critics say BNPL for rent feels "dystopian"

On social media, criticism of the payment plan was swift. More Perfect Union (@MorePerfectUS) wrote, "The financialization of everything must be stopped." Meanwhile, @2903DOT02_50 labeled the idea "Dystopian AF."

Others focused on what BNPL rent signaled about society. @DarrigoMelanie tweeted that using BNPL "for basic necessities like food, housing and healthcare is a sign of a sick society that incentivizes the exploitation of our survival for profit. This is not sustainable."

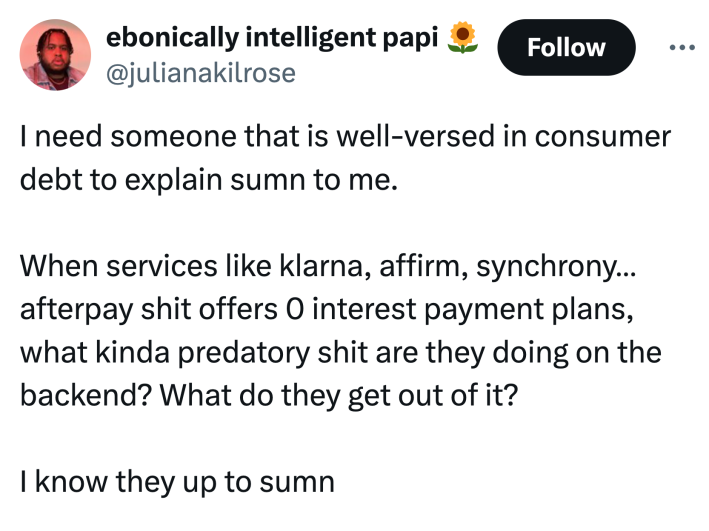

Some others questioned how companies profited from 0% plans. @julianakilrose asked what "predatory sh*t" happened behind the scenes.

In response, @jamiekaywilde said companies mainly earned money from merchants paying transaction fees.

@GivnerAriel wrote that "'0% interest' just means the cost is hidden," and @Katjerrr added that the consumer is the product in this case. "Besides what people are mentioning below about cuts, etc., they’re 'anonymizing' your data and selling it to people."

@ConjureCreature argued that startups often ran at a loss, then worsened products later to recover money.

Others warned that the system punished missed payments or worsened housing problems.

@titanwuzh3re noted, "have you seen the fees if you miss a payment? they’ve reinvented payday loans."

Using buy now, pay later apps for basic necessities like food, housing and healthcare is a sign of a sick society that incentivizes the exploitation of our survival for profit.

— Melanie D'Arrigo (@DarrigoMelanie) January 22, 2026

This is not sustainable. https://t.co/ICNDlFiaAv

@crum_madison_ pointed out, "This doesn’t allow you to get ahead - it will make falling behind even easier. Splitting up payments or 'rent now pay later' won’t help housing affordability crises, only worsen it."

The internet is chaotic—but we’ll break it down for you in one daily email. Sign up for the Daily Dot’s newsletter here.